Our researchers' perspectives on rising business insolvencies

Feb. 17, 2023

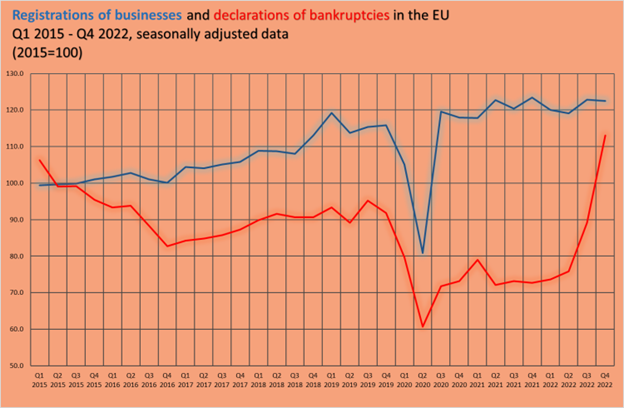

Business insolvency is on the rise across Europe as companies are under economic pressure and have to start repaying state-backed loans that were introduced during the COVID-19 pandemic. We have spoken to some of our researchers about the rising number of bankruptcies and the impact of the end of different government support programs on business and economies around Europe.

This article was first published on Feb. 17, 2023, it was last updated on April 18, 2023.

Post-pandemic recession creates stress for European insolvency systems

“When covid hit, and many contact-dependent industries ground to a virtual halt, predictions for a dramatic rise in insolvencies were commonplace. I too predicted rising business closures and busy insolvency courts. This turned out to be wrong, for two important reasons. First, there was extensive public support for businesses that were locked down, to protect employment, to delay debt repayment and to support consumption. The policy mix varied between countries, but data on bankruptcies and insolvencies prove that the interventions worked well in avoiding firm failures. Second, the rich economies proved remarkably apt at moving online.

But now, bankruptcy data suggest rising stress among European firms. Part of the problem is the exact set of policies that proved so helpful in 2020 and 2021. Many of these policies postponed various financial obligations for firms, such as debt repayment and tax payments, and now many of these are due. Firms also borrowed to survive the pandemic, and, again, some of the debt is now due.

In every recession firms fail, and that is not always bad. When a less productive business closes its resources are freed up for other uses. This is part of the natural evolution of the economy. But there are reasons to be concerned. First, when many firms close at the same time, displaced workers may struggle to find alternative employment. Second, the banking system may suffer losses which reduce their supply of credit to firms and households, exacerbating a downturn. And third, formal procedures for insolvency often liquidate firms which could be profitably restructured. In this, the European insolvency system lags that of the U.S., with negative implications for bank lending and bond markets and for the wider economy. European reform efforts are definitely pushing in the right direction.”

How can government lending programs affect businesses and the economy in Sweden?

“Sweden extended and expanded its corporate loan program in December 2022 to ease the impact of the energy crisis. This program was launched in 2020 to support liquidity constrained firms following the Corona Pandemic, and it enabled firms to postpone paying social security contributions, personal income taxes, and value added taxes. This temporary tax deferment is treated as a loan from the Swedish government. The program launched in 2020 has now been extended and expanded for firms wishing to defer tax payments until September 2023. The loans can (in part) be extended for up to 36 months if firms sign an amortization schedule with the tax authority. While it may be useful to extend the lending program to accommodate for the current situation, at some point the deferred taxes needs to be repaid. This can lead to debt overhang problems and prolong the economic downturn. Furthermore, other lenders may be reluctant to lend to firms that have high priority loans from the government.”

Strong upward trend of bankruptcies and affected employees in Sweden

SHoF’s visiting researchers Christian Thomann and Gustav Martinsson also looked into the newly released data on Swedish bankruptcies, showing a sharp upwards trend in January 2023.

“The increase in the number of bankruptcies in January 2023 (up by 60% compared to January in 2022) represents the largest January increase since the official monthly statistics started in 1994,” Thomann and Martinsson say. “The increasing trend in bankruptcies that started in August of last year is continuing its rapid upward trajectory.”

Bankruptcies in Sweden are still increasing, but at a lesser rate. As of March 2023, insolvencies increased 17% in February compared to the same month a year earlier, and increased again in March, this time by 13% year on year.

"The increase in March sounds considerably lower, but it's still the fourth largest March increase since the data series began," Martinsson says.

Figure 1. Bankruptcies 1995-2023

Source: Raw count of bankruptcies (% changeg by calendar month) 1995M01-2023M01 (The Swedish Agency for Growth Policy Analysis)

Notes: Change by calendar month is taking the percent change between, e.g., January 2023 and January 2022. 6MO MA refers to a six-month moving average to smooth out series

The second graph (Figure 2) measures the percent change in the number of employees affected by the bankruptcies in the previous graph (Figure 1).

In terms of the number of bankruptcies, there were visible trends of increases in 2012 and 2018 which do not show up as very large when they are weighted by number of employees. This suggests that the companies who declared bankruptcy in these periods were quite small and employed few people.

The present upward trend of bankruptcies becomes more pronounced when we consider the number of affected employees. The strong upward trend that began in August 2022 is continuing its upward journey and the only comparable event in the data going back to 1995 is the bankruptcy wave of 2008-2009. During this period there were 14 months of increasing bankruptcy rates of between 30% and up to 250%. In the current six-month period, the of increasing bankruptcy rates have varied between 20% and up to over 400%.

In March 2023, the increase in bankruptcies weighted by employees has increased by 81% compared to the year earlier.

“This is the third highest since the data began, after March 2020’s data when the pandemic crashed down on the economy, and in 2009 amid a very deep recession,” Martinsson says.

Figure 2. Bankruptcies, employees affected 1995-2023

Source: Bankruptcies weighted by employees affected (% change by calendar month) 1995M01-2023M01 (The Swedish Agency for Growth Policy Analysis)

Notes: Change by calendar month is taking the percent change between, e.g., January 2023 and January 2022. 6MO MA refers to a six-month moving average to smooth out series

Takeaways

“The current trend of increasing bankruptcies is steeply upward trending. However, when the size of the bankruptcies is considered, the current wave becomes even more pronounced. In fact, it is only during the 2008/09 financial crisis that we have seen a similar upward trend. Then there were 14 months of increasing bankruptcy rates.

Admittedly, the current macro environment, with most notably high inflation, makes it more challenging to design strong policy responses. But there might be room for effective policy solutions brought to the table to prevent, what is already looking like a hard landing into, a crash landing of the economy.”