Hans Dalborg Award 2025 Ceremony & Presentations

Apr. 23, 2025

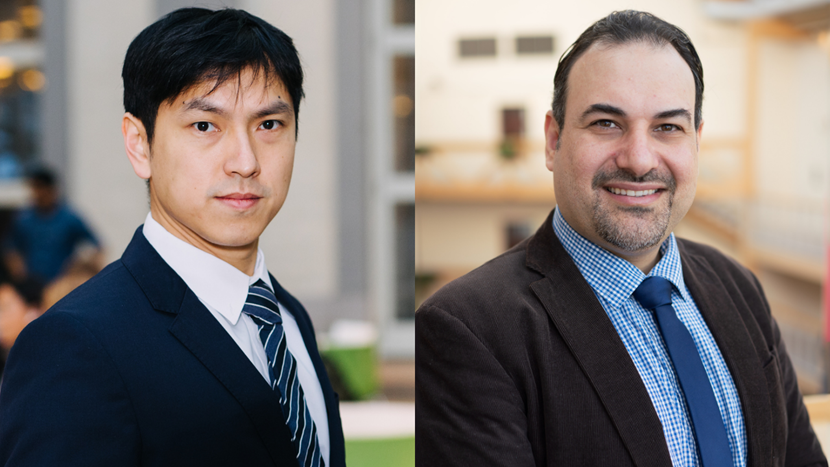

Alvin Chen (Swedish House of Finance/Stockholm School of Economics) and Mustafa Nourallah (Mid Sweden University) are this year’s recipient of the Hans Dalborg Award for Excellence in Research in Financial Economics.

The recipients of this year’s Hans Dalborg Award for Excellence in Research in Financial Economics are Alvin Chen, Resident Researcher at the Swedish House of Finance and Assistant Professor at the Stockholm School of Economics, and Mustafa Nourallah, Assistant Professor at Mid Sweden University.

The Award ceremony will be taking place in-person on May 8 at SSE at16:30. Following the presentations, our board and members will be conducting the business portion of the Annual meeting.

Presentations

The Logic of Non-executive Equity Incentives

Alvin Chen, Assistant Professor at Stockholm School of Economics and resident researcher at Swedish House of Finance.

The prevalence of broad-based equity incentive programs is a bit of a mystery. Standard economic theory predicts they should be ineffective due to the free-rider problem, yet more and more firms use them for incentive purposes.

“My research focuses on how agency problems shape corporate policies. In this presentation, I will explain how equity pay can encourage employee engagement even when there are severe free-rider problems. My framework has many implications for the setup of tasks, the design of compensation schemes, and the accumulation of firm-specific human capital.”

What Drives Loyalty and Trust in FinTech? Insights from Young Users

Mustafa Nourallah, Assistant Professor at Centre for research on Economic Relations (CER) at Mid Sweden University

User-friendly design and cognitive considerations are crucial for the success of digital financial solutions.

“In my presentation I will explain what drives loyalty and trust in two types of digital financial services among young users: mobile banking apps and robo-advisors. My research consists of four published papers—two focusing on the factors influencing loyalty to mobile banking apps, such as memorability, confidentiality, and understandability, and two examining what shapes trust in robo-advisors, including perceived risk, decision styles, and cultural factors.”