License to Call: Callable Bonds Mitigate Debt Overhang, Increase Corporate Flexibility

Sep. 17, 2024

Callable bonds, which issuers can repurchase before maturity, is an important tool of corporate financial management, according to an award-winning study by Swedish House of Finance’s Bo Becker, Finansinspektionen’s Victor Thell, Erasmus University’s Dong Yan, and Cornell University’s Murillo Campello.

These bonds allow issuers to repay their debt before maturity, typically when market conditions improve, enabling companies to refinance at lower interest rates. This can improve investment incentives by reducing debt overhang and providing greater flexibility, the study showed.

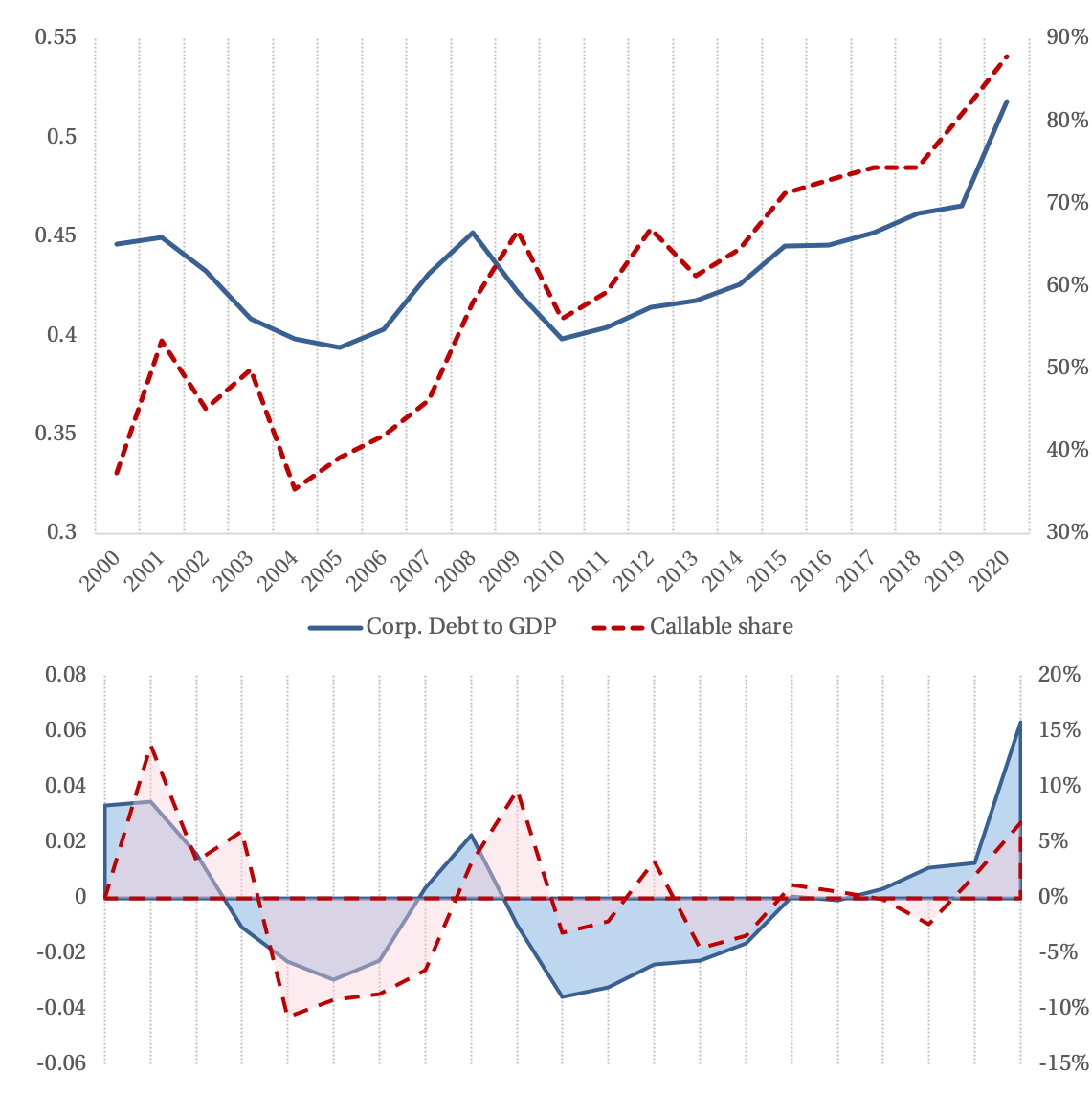

Figure 1. Callable Share and Leverage. This figure presents U.S. corporate debt (as a percentage of GDP) from Flow of Funds data, and the callable share of new bond issues from Mergent FISD. The top panel shows the levels (leverage on the left scale), while the bottom panel displays detrended leverage and callable share. The correlation between the two series is 0.6 (P = .001).

These benefits of callable debt are particularly valuable when credit markets are strained and new bonds are issued at high cost; “The issuance of callable bonds has spiked both during the 2000–2001 recession, the Financial Crisis, and the COVID-19 Crisis,” the authors say, noting that the share of callable bonds in new corporate bond issues grew from 35% in 2000 to 89% by 2020.

Managing Debt in Tough Times

The appeal of callable bonds lies in their ability to offer a safeguard against adverse financial conditions. For example, if a company's credit rating improves or if market interest rates decline, it can call the bonds and reissue them under better terms.

The authors found that callable bonds typically offer about 27 basis points (0.27%) higher yields at issuance compared to non-callable bonds, compensating investors for the potential risk of the bonds being called early.

Callable bonds also address debt overhang, where existing debt discourages companies from investing in new projects. These bonds allow companies to buy back their debt at or close to par, meaning at nearly the original value of the debt. This flexibility makes it easier for businesses to pursue growth opportunities, such as mergers.

Key in Corporate Finance

Callable bonds have become essential in corporate finance for managing financial risks, particularly in volatile markets. The study emphasizes their critical role in capital structure decisions and corporate strategies, especially in facilitating mergers and addressing debt challenges.

The authors note that “debt callability is a key capital structure parameter—similarly to debt seniority and maturity—bearing important implications for observed corporate behavior.” The growing use of callable bonds underscores their strategic value in today’s financial landscape.