Financial market regulation debate

dec. 15, 2014

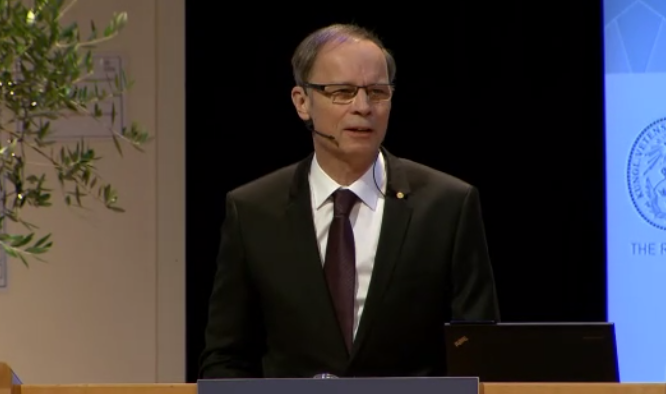

On Sunday December 7, the Swedish House of Finance welcomed this year’s Nobel prize Laureate Jean Tirole. Joining him in a discussion on the regulation of financial markets were Martin Andersson, Director General of the Swedish Financial Supervisory Authority, FSA, and Thomas Östros, Managing Director of the Swedish Banker’s Association. Per Strömberg, Centennial Professor of Finance and Private Equity at Stockholm School of Economics moderated the discussion. Some 50 specially invited guests took the chance to listen and ask questions to this very distinguished panel.

Jean Tirole is a giant in the field of Economics. He has done much research on the regulation of large firms and this was part of the motivation for his Nobel prize. But he has also studied the regulation of financial markets and can bring much insight to this area.

Any discussion of financial market regulation at some point touches the financial crisis of 2008.

– Even though we knew some things were wrong, we had no idea about the magnitude of the problems before the crisis erupted. Most ingredients were present but we could not put it together and I’m guilty like everybody else, said Jean Tirole.

Martin Andersson agreed and added that there was a widespread belief amongst regulators that the bankers were smart people that knew how to handle their risks and regulators shouldn’t challenge this.

– We were stupid enough to believe them when we should have known better, he said.

A current topic in Sweden and many other countries is macro prudential regulation. Thomas Östros gave a background to the recent debate in Sweden whether to give the macro prudential regulatory tools to the Central Bank or to the FSA. He stressed the importance of coordination of micro and macro regulation, both for the industry and for the regulators.

Jean Tirole tended to agree with Thomas Östros but also added that there is no clear answer and that the jury is still out on how to best coordinate micro and macro regulation.

– The good thing about focusing on an inflation target for the Central Bank is that it’s simple. There is a point in not complicating things, said Jean Tirole.

The panel also discussed the role of liquidity in the markets today and the problems of how to define high quality liquid assets. Thomas Östros brought up the problem of combining economics and politics. In Europe, different countries use different definitions of high quality liquid assets, which can be problematic on a EU-level.

– It turns out to be a political discussion. What is really liquid and what is politically liquid, said Thomas Östros.

Martin Andersson discussed the role of liquidity during the financial crisis.

– One thing that struck me during the crisis was why the governments only tried to provide liquidity to the market through banks. I never heard any discussion on other means of getting liquidity out on the market, said Martin Andersson.

– The shadow banking system is playing an increasingly important role in the economy these days. I believe that if everybody competes on a level playing field this is not a problem but if the playing field is not even – this could be problematic. From a regulative point of view, it becomes more difficult to know which actors are systemically important in the future. It is difficult for regulators to cover the shadow banking system, said Jean Tirole.

The debate concluded with a discussion of a banking union.

– I’m very much pro a bank union. Some things that national agencies are not able to do, a banking union might be able to solve, said Jean Tirole.

Thomas Östros agreed that it is an important initiative, especially for the Eurozone countries but added that it is more complicated when it comes to the Swedish context.

– The tendency I see so far is that it is based on a lot of quantitative data. If there is one thing we know it’s that in real life, judgment and active valuation of situations is important and my fear is that this type of machinery will not be able to act until it is too late, said Martin Andersson.