Rethinking Mortgage Rules in Sweden: Balancing Stability and Accessibility

dec. 16, 2024

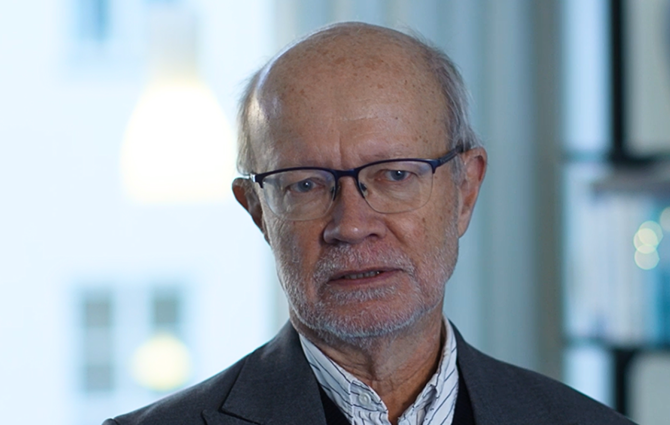

Sweden’s mortgage regulations, designed to safeguard financial stability, are now under review. A government-appointed committee, led by Swedish House of Finance’s Peter Englund, has proposed significant changes aimed at striking a balance between protecting the economy and enhancing housing accessibility.

In this interview, Peter Englund (SHoF/ Stockholm School of Economics) explains the dual focus of the committee’s mandate:

“We were asked to evaluate (existing measures) from the viewpoint of its impact on financial stability, but we were also asked to come up with suggestions for reform of the system,” Englund says.

He also discussed:

- The purpose of mortgage rules, and how regulations, such as the loan-to-value (LTV) cap and amortization requirements, were introduced to protect financial stability and prevent systemic risks.

- The committee’s proposed reforms.

- Reactions from various stakeholders to the proposed changes.